By Luis Fernando Espejo & Emiliano Hernández

Mexico: The Missed Opportunity Where Passion, Culture, and Football Unite

Mexico is more than just numbers or financial data—it’s a country steeped in rich cultural traditions and a deep passion for football. Each city offers distinct cuisine, festivals, and customs, creating a vibrant atmosphere that is deeply intertwined with the nation’s football culture. This emotional connection to the sport runs through generations, with club loyalty being a powerful, longstanding tradition.

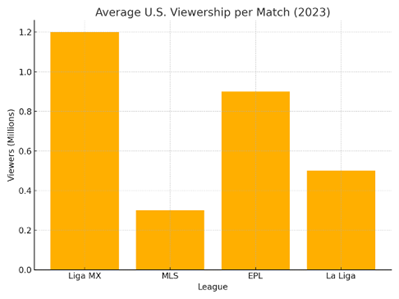

This passion translates into one of the largest football fan bases in the world. Liga MX, the country’s top professional league, is the most-watched football competition in North America, surpassing Major League Soccer (MLS) and even competing with some European leagues in terms of television audience. With over 70 million fans, Mexican football has become a highly attractive product for sponsors and television networks.

Liga MX’s agreements with various national and international broadcasters have expanded its reach, strengthening its presence in strategic markets such as the United States, where more than 36 million Latinos actively follow Mexican football. This impact has bolstered club revenues through sponsorships and broadcasting rights, creating a more robust financial ecosystem. Despite its massive audience, Liga MX remains an underdeveloped asset in the global sports investment landscape. Its dominance among the Hispanic market in the U.S. places it ahead of both the Premier League and MLS in this key demographic, making it a largely untapped opportunity for investors.

More than just a competitive league, investing in Liga MX means becoming part of a culture that blends passion, music, food, and football. This combination of cultural depth and sporting commitment makes Mexico an unparalleled environment for growth, where the market is not only lucrative but also deeply engaging. Today, factors such as political shifts, the upcoming 2026 World Cup, international investment, and Mexico’s rich football culture are aligning to make Liga MX one of the best sports investment opportunities of the decade. The recent offer by Apollo Global Management to acquire a stake in the league’s international broadcasting rights further underscores its attractiveness to global capital.

The World Cup Effect (2026)

As one of the host nations for the 2026 FIFA World Cup, Mexico is undergoing significant upgrades in stadium infrastructure, logistics, and tourism facilities. These improvements not only enhance the tournament experience but also strengthen Liga MX’s long-term commercial appeal, making it a more valuable asset for investors and stakeholders.

| CITY | STADIUM | X INVESTMENT (USD$) |

| Mexico City | Estadio Azteca | $150M |

| Guadalajara | Estadio Akron | $80M |

| Monterrey | Estadio BBVA | $70M |

Political and Economic Context: A Stable Investment Landscape

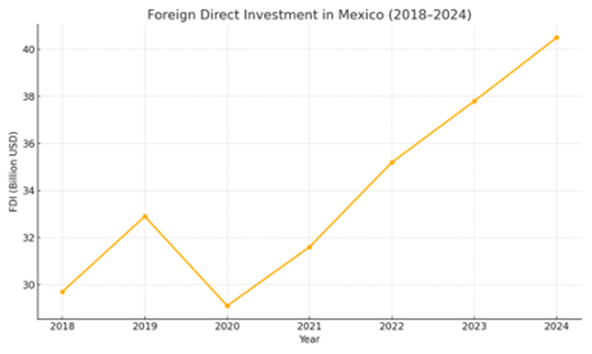

The election of Claudia Sheinbaum as Mexico’s president in 2024 has reinforced economic stability and investment confidence, ensuring continuity in infrastructure development and market growth. Her administration promotes public-private partnerships, attracting global companies like Toyota, Volvo, and Intel, while fostering economic zones and talent hubs.

These companies are investing heavily in Mexico, with Toyota committing 1,450 million dollars to modernize its plants, Volvo investing 700 million dollars in a truck factory in Monterrey, and Intel dedicating 20,000 billion to expand semiconductor production in Chihuahua, strengthening Mexico’s role in the automotive and tech industries.

The “Plan México”, a joint initiative between the government and the private sector, aims to boost industrial development, nearshoring, and economic competitiveness by enhancing strategic sectors and facilitating foreign investment.

Additionally, major infrastructure projects, such as the Interoceanic Corridor of the Isthmus of Tehuantepec, are strengthening trade connectivity between the Pacific and Atlantic, while the national railway expansion plan is revitalizing freight and passenger transport, reinforcing Mexico’s logistics network.

With a stable macroeconomic environment, an evolving regulatory framework, and increasing foreign investment openness, Liga MX stands at the center of a thriving industry, poised for unprecedented growth and international capital inflows.

The TV Rights Goldmine: Centralization and Growth Potential

Liga MX continues to dominate U.S. television, especially among Hispanic and bilingual audiences, with clubs like Chivas and Club América regularly breaking viewership records. This audience has made Liga MX one of the most-watched leagues in North America, surpassing even the Premier League and MLS in key demographics. Yet, despite its massive reach, the league’s broadcasting rights remain fragmented – leaving major revenue on the table.

The Mexican Football Federation (FMF) is working toward centralizing broadcasting rights by 2028, aiming to unify the rights for Liga MX, the Mexican national team, and sponsors. This centralization effort seeks to create a more streamlined and financially advantageous model for all stakeholders. By consolidating rights, the federation believes the commercial potential will increase, making the overall market more attractive and lucrative for investors.

The shift toward centralizing broadcasting rights is expected to equalize revenue distribution among clubs, allowing teams to reinvest in their infrastructure and improve their competitive standing. This move will not only enhance financial stability but also position Liga MX for future growth, increased sponsorship opportunities, and a stronger presence in the global football market. The push for streaming innovation and consolidated broadcasting rights further strengthens Liga MX as one of the most valuable untapped football properties worldwide.

Toward a Regional Powerhouse: The Role of Leagues Cup and the Path to Integration

The effort to centralize Liga MX’s broadcasting rights is not just a domestic reform—it’s a strategic move aligned with broader regional ambitions. As Liga MX solidifies its media structure and enhances its commercial appeal, it becomes a more viable partner in the ongoing integration with Major League Soccer (MLS) and the Canadian Premier League.

One of the clearest examples of this growing synergy is the Leagues Cup, a tournament that has quickly evolved into a high-stakes, high-reward competition. With a prize pool of approximately $40 million, the tournament offers significant incentives:

- $200,000 per group stage match, split equally between club and players.

- $50,000 bonuses for each group stage victory.

- Up to $2 million for the champion, combining match earnings and final-stage bonuses.

These figures demonstrate the competition’s serious economic impact and growing prestige. But more than just prize money, the Leagues Cup serves as a testing ground for what many see as the future of North American football: a regional league that brings together the best of MLS, Liga MX, and Canada under a unified competition model.

A cross-border league would not only enhance competitiveness but also dramatically expand commercial and broadcast opportunities. With centralized rights and joint ventures, the region could attract unprecedented media deals, sponsorships, and investment. For clubs, this means greater financial stability, improved infrastructure, and enhanced player development pathways. For fans, it promises higher-quality football and a more immersive experience.

As the 2026 World Cup approaches—hosted jointly by the U.S., Mexico, and Canada—the momentum toward a regional football ecosystem is undeniable. The Leagues Cup, with its rising popularity and financial incentives, may well be the blueprint for the next era of the sport in North America.

Recent Success Stories: How Foreign Investors Are Transforming Liga MX

Necaxa and Atlético San Luis stand out as prime examples of the growing influence of foreign investment in Liga MX. In 2021, NX Football USA LLC acquired a stake in Necaxa, bringing with it an innovative management model that has strengthened both the sporting and commercial structures of the club. This investment has enabled Necaxa to enhance its infrastructure, expand its marketing strategies, and form valuable connections with MLS and Premier League executives and investors. Notable investors in Necaxa include Eva Longoria, Mesut Özil, and Al Tylis, underscoring the international appeal of Liga MX clubs.

Necaxa has undergone a rebranding process, positioning itself as a modern and data-driven club. It has placed a strong emphasis on youth development, using advanced data analytics to identify and nurture young talent, ensuring long-term sustainability and competitiveness.

Similarly, Atlético San Luis, owned by Atlético de Madrid, leverages a strategic talent pipeline, facilitating the movement of promising players between Mexico and Spain. The club also benefits from synergy with its parent club, applying European methodologies in player development, tactical planning, and scouting.

Both clubs are reshaping their commercial strategies and embracing international best practices, demonstrating that Liga MX is an increasingly attractive market for foreign investors. The success of Necaxa and Atlético San Luis signals the potential for further modernization and global expansion within Mexican football.

A Natural Fit for Global Multi-Club Ownership Models

Given the current state of Mexican football—characterized by increased openness to foreign investment, regulatory flexibility, and a growing need for modernization—it would not be surprising if globally recognized multi-club ownership (MCO) groups, such as Red Bull and City Football Group, which have already acquired clubs in this region, or Eagle Football Holdings and the Pozzo Group, which have yet to acquire any, were to invest in a Liga MX club in the near future.

Liga MX offers an ideal environment for these groups to expand their networks: a large, passionate fan base, strong media presence in the U.S. and Latin America, and clubs seeking strategic partnerships to elevate their sporting and commercial models. The conditions are aligned, and the opportunity is ripe.

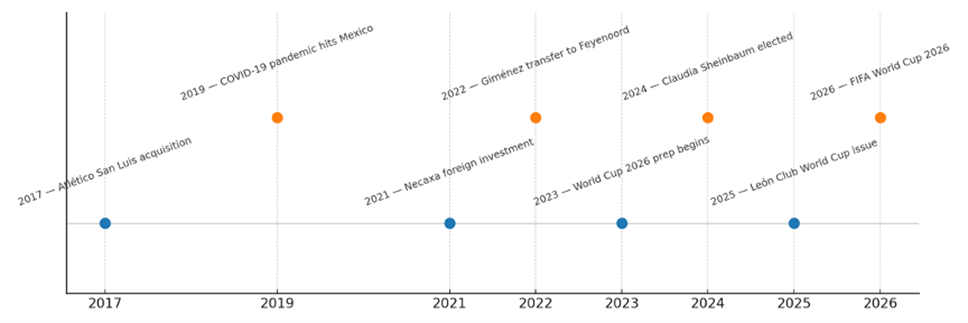

Timeline of Key Investment Milestones in Liga MX

Liga MX’s rise as a prime investment opportunity has been shaped by several pivotal moments. Below is a timeline that outlines the key milestones in its evolution:

A Growing Market with Flexible Entry Points

The Liga MX franchise market has experienced consistent growth, with valuations starting at approximately $140 million, including full club assets.. However, structured acquisition models, such as phased investments or strategic partnerships, provide investors with entry opportunities starting at $30 to $40 million. These flexible investment frameworks enable capital partners to gradually expand their ownership stake while leveraging the commercial and sporting potential of one of the most dynamic and commercially viable football leagues in the Americas. Additionally, acquiring a franchise grants voting rights in the league’s decision-making processes, allowing investors to actively shape the league’s strategic direction and governance.

Discussions are underway regarding the potential expansion of Liga MX to 20 teams by 2026. Reports suggest that two new Liga MX’s franchises could be sold to the highest bidder, signaling a possible shift in the league’s approach to growth and governance. While not yet confirmed, this development could open new investment opportunities, reinforcing Liga MX’s appeal as a dynamic and financially evolving football market. Investors should closely monitor these changes as the league continues to explore ways to strengthen its financial ecosystem.

A recent incident involving León’s disqualification from the Club World Cup due to paperwork issues has sparked a wider conversation about governance in Liga MX. This situation has prompted a reassessment of risk management and compliance practices, opening opportunities for investors to bring more sophistication to club operations. For more details on this case and its broader impact on Liga MX, check out our detailed article here.

The likely exclusion of Club León from the FIFA Club World Cup over ownership structure issues reinforces FIFA’s hardline stance against multi-club ownership. This development pressures Liga MX to accelerate governance reforms and pushes clubs like Atlas, Santos, Querétaro, and Puebla—currently part of shared ownership groups—into the spotlight as potential acquisition targets.

For investors, this marks a strategic moment: as regulatory shifts demand greater transparency and independence, new capital partners have a unique opportunity to enter the Mexican football market, acquire majority stakes, and help lead the professionalization of club operations in one of the most commercially promising leagues in the Americas.

Young Development Expertise: The Strength of Liga MX’s Youth Academies

Liga MX is home to some of the most robust youth development systems in the world, with clubs investing heavily in state-of-the-art facilities, training complexes, and clubhouses that nurture young talent. These infrastructures include world-class sporting facilities, academy housing, and dedicated operational and coaching staff, all aimed at developing players who can compete at the highest levels. Clubs like CF Pachuca, Club Santos Laguna, and CF América have long invested in these infrastructures, ensuring that young players receive top-tier coaching, medical care, and training. Facilities like those of Pachuca and Santos Laguna are so advanced that they will host international teams during the 2026 World Cup. These institutions are no longer just training grounds; they are high-performance incubators capable of producing world-class talent.

For investors, youth development is not just an expense—it’s a high-potential asset in a growing global market. Take this development path as an example:

- 1 year in U13: $15,000

- 1 year in U15: $15,000

- 2 years in U18: $20,000

- 2 years in U23: $34,000

- Total investment: $138,000

This figure covers coaching, nutrition, medical care, housing, and travel. Recently, a mid-tier club sold one of its academy players for $6 million USD—yielding a remarkable 44x return on investment (ROI).

The focus on youth development is evident in the increased emphasis on providing young players with access to elite-level coaching and exposure to first-team environments. The combination of high-quality facilities and specialized staff offers a clear path for young talent to rise through the ranks and eventually break into professional football.

As a result, this structured development not only benefits domestic clubs but also reinforces the growing confidence European teams have in Liga MX’s academies. In recent years, several young Mexican players have transferred to European clubs after completing their youth development in Mexico, often with little

first-team exposure in Liga MX. This underscores the effectiveness of these academies in producing high-potential talent that can immediately attract interest from international markets.

Case Example: Stephano Carrillo, developed at Santos Laguna and sold to Europe for $4M USD in last winter transfer market, exemplifies this trend. His transfer is part of a new wave of talent proving that Liga MX academies are not only competitive in player development but also financially valuable in the global market.

Historic Transfers: The Rise of Mexican Talent in European Football

In recent years, several Mexican players have made the jump from Liga MX to top European clubs, demonstrating the league’s ability to develop exportable talent. This table highlights some of the most notable transfers during this period.

| PLAYER | FROM CLUB | TO CLUB | Fee (€M) |

| Santi Giménez | Cruz Azul | Feyenoord | 6 |

| Edson Álvarez | América | Ajax | 15 |

| Diego Lainez | América | Real Betis | 14 |

| Raúl Jiménez | América | Atlético Madrid | 10.5 |

| César Montes | Monterrey | Espanyol | 8 |

| Hirving Lozano | Pachuca | PSV | 12 |

| Cesar Huerta | Pumas | Anderlecht | 2.5 |

| Rodrigo Huescas | Cruz Azul | FC Copenhagen | 2 |

Mexican football has immense talent, yet player exports to Europe remain limited compared to countries like Brazil and Argentina. While recent transfers indicate progress, Mexico must refine its strategy to become a consistent talent pipeline. One of the key challenges to overcome is the high transfer fees, which discourage European clubs from pursuing Mexican players. Additionally, the limited international visibility of Mexican football reduces scouting opportunities, and development gaps leave players unprepared for the demands of Europe’s top leagues. To foster growth, it is crucial to adopt more flexible negotiations that facilitate transfers, strengthen partnerships with European clubs for greater exposure, and enhance scouting and training programs to ensure players meet elite football standards. Furthermore, providing more playing time for young talent in Liga MX is essential to give them the experience needed to succeed at the highest levels.

Mexico has the talent to compete globally, but structural improvements are needed. By aligning with international best practices, Liga MX can become a top exporter of world-class players.

Dual Nationals in Liga MX: A Long-Term Opportunity, Not a Short-Term Solution

While the model of integrating Mexican-American dual nationals into Liga MX clubs is not currently a viable or proven strategy, it remains a concept with considerable long-term potential. Presently, key limitations—such as a lack of integration infrastructure, low conversion rates from prospect to impact player, and uncertain financial returns—have prevented widespread adoption. However, the growing pool of U.S.-developed talent with Mexican heritage, combined with the advantage of registering them as domestic players, suggests that with proper investment in scouting, adaptation programs, and institutional planning, this approach could evolve into a competitive and profitable pathway. As it stands, this is less of a short-term solution and more of a forward-looking strategy—one that will require vision, commitment, and structure to unlock its full value.

Liga MX: A Strategic Bridge to Global Football Markets

Liga MX has established itself as a vital stepping stone for foreign players aspiring to reach top international leagues. Mexican clubs have built a strong reputation for scouting, developing, and showcasing talent—particularly from Central and South America—often acquiring players at relatively low cost and selling them later at a significant profit. This dynamic has positioned Liga MX as a strategic intermediary within the global transfer ecosystem.

Now, the league is uniquely positioned to go a step further by spearheading the development of a regional “bridge league” model. Through strategic alliances and feeder systems with clubs across the Americas, Liga MX could formalize a talent pipeline that connects emerging players from Central and South America with opportunities in the U.S. and Europe.

Such a structure would allow clubs to identify and nurture young talent earlier, offering them development in a competitive and commercially visible environment before facilitating their move abroad. It would also enhance Liga MX’s role as a hub for talent circulation in the Western Hemisphere, reinforcing its sporting relevance and financial potential.

In today’s interconnected football landscape, Liga MX has the infrastructure, visibility, and market influence to lead the creation of a sustainable, cross-border development system—one that benefits players, clubs, and investors alike.

The following table showcases notable examples of foreign players who transitioned from Liga MX to clubs abroad.

| PLAYER | LIGA MX CLUB | Acquisition Cost Fee (€) | FOREIGN CLUB | Transfer Fee (€M) |

| Enner Valencia | Pachuca | 3.2 m | West Ham United | 15 |

| Julian Quiñones | América | 9.1 m | Al-Qadisiya | 13.8 |

| Mateus Uribe | América | 5 m | FC Porto | 9.5 |

| Jackson Martínez | Jaguares de Chiapas | 2.8 m | FC Porto | 8.8 |

| Guido Pizarro | Tigres UANL | 3 m | Sevilla FC | 8.7 |

| Brian Fernández | Necaxa | 600 k | Portland Timbers | 9 |

| Alberth Elis | Monterrey | 300 k | Houston Dynamo | 2.2 |

Stars in Liga MX: A Global Stage for Football Talent

Liga MX has evolved into a premier destination for international superstars, boosting the league’s global stature. High-profile players like Sergio Ramos, who joined Monterrey, and James Rodríguez, who signed with León, have elevated the league’s visibility and engagement, particularly in Latin America. This influx of talent has not only enhanced the league’s profile but also increased its competitiveness, as demonstrated by 17 Liga MX players being called up to their national teams during a recent FIFA break. The arrival of these stars underscores Liga MX’s growing relevance in the global football landscape.

Geographic and Climate Advantage: A Strategic Hub for International Football Activity

Beyond its football infrastructure, Mexico’s temperate climate represents a strategic advantage for both domestic and international clubs. The country’s geographic diversity offers optimal conditions for preseason camps, friendly matches, and training sessions virtually year-round. This ability to host uninterrupted football activity supports the continuous development of players and enables the organization of tournaments throughout the calendar.

Mexico becomes an attractive destination not only for players and fans, but also for clubs from Europe, North America, and other regions that may consider the country a reliable base for their off-season activities. In addition to boosting the local economy, this dynamic opens doors to global marketing opportunities and enhances Liga MX clubs’ international visibility through high-profile events and cross-market engagement strategies.

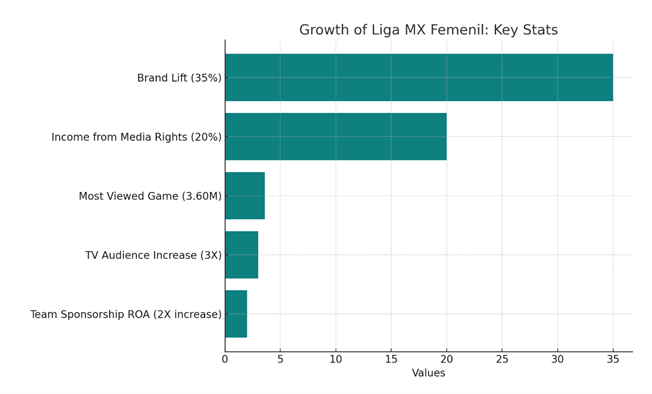

Expanding Investment Opportunities in Liga MX Femenil

Liga MX Femenil has rapidly grown into one of the most competitive women’s leagues in the region. Unlike other markets, every Liga MX club is required to have a women’s team, making franchise ownership even more attractive for investors.

This structure not only enhances the league’s competitiveness but also opens new revenue streams through sponsorships, broadcasting rights, and merchandise sales. Additionally, the increasing presence of Mexican players in top international leagues boosts the league’s credibility and marketability. For investors, Liga MX Femenil offers both financial potential and a chance to contribute to gender equity in sports.

A Defining Moment for Investment in Liga MX

Liga MX stands on the edge of a historic opportunity, as it combines a rich football culture with dynamic growth prospects. With the 2026 FIFA World Cup on the horizon, the league is poised for global exposure, increased revenue streams, and an enhanced reputation. Structural reforms are modernizing governance, while the influx of foreign investment is improving club management and infrastructure, propelling the league to new heights.

The unique binational market of Mexico, coupled with its unwavering football passion, makes Liga MX a prime destination for investors seeking high-return opportunities in a rapidly evolving sports market. This is not just a regional powerhouse; it is a global football market in the making.

For those looking to make a significant impact in the sports industry, Liga MX offers a fertile ground for strategic investment. Now is the moment for visionary investment to drive Mexican football to its full potential. The opportunity to shape the future of the league and tap into its growing influence on the global stage has never been clearer.