Neymar’s €180 million transfer to Paris Saint-Germain in 2017 made headlines, but almost no one mentioned the extra 10-20% in undisclosed fees, which raised the total cost to much over €200 million. A considerable percentage of each major signing is lost before play starts owing to withholding taxes, VAT for “player services,” stamp costs, and capital-gains levies.

Top clubs use an eight-step plan to prevent those millions from slipping away. Before establishing a home-base subsidiary (the SBV) to complete the purchase, they first map out every potential tax trap. They then employ lease-back agreements to retain the player on their books and spread the cost over the duration of the contract, channel the fee via a treaty-friendly offshore company (the SPV), and repatriate any revenues in the most tax-efficient manner. Strict adherence to actual offices, authentic board meetings, and thorough paperwork guarantees that nothing will fall apart when examined closely.

Case studies such as Jude Bellingham’s move to Real Madrid and Arsenal’s image-rights structure in Ireland show precisely how this strategy keeps transfer budgets healthy.

Top clubs use an eight-step plan to prevent those millions from slipping away.

Identifying All Tax Liabilities

Before pen meets paper, every club must pinpoint each tax “bite” on a transfer:

- Withholding Tax Up to 30 percent can be held at source when Club A in Country X pays Club B in Country Y.

- VAT/GST: Treating a transfer as “player services” can trigger a 10–20 percent levy.

- Stamp Duty / Transfer Tax: In markets like Brazil or parts of Asia, a 0.1–0.5 percent fee quietly applies.

- Capital-Gains Tax: Any profit booked by the selling club may be taxed before the money ever leaves.

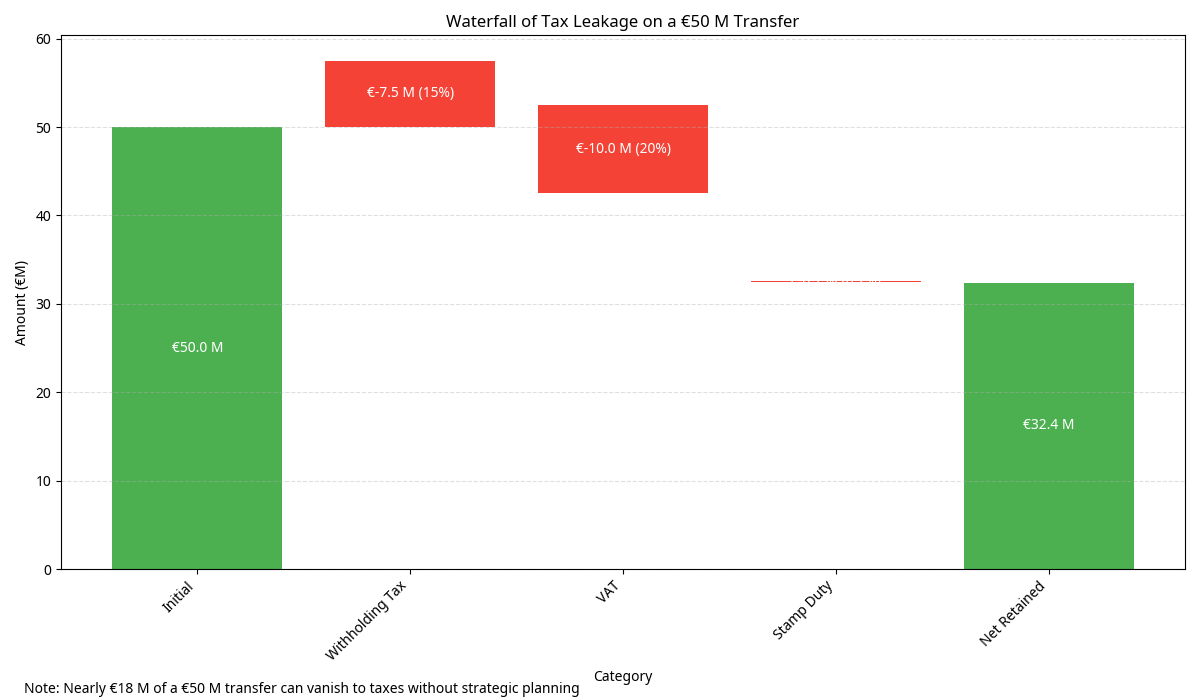

The magnitude of unstructured tax outflows on a simple €50 million transfer is seen in this waterfall graphic. A club would only have €32.4 million of the initial amount left over after €7.5 million would be lost to withholding tax, €10 million would be consumed by VAT on “player services,” and a meager €0.1 million would be lost to stamp duties if no preparation was made. This loss of resources of about €18 million highlights the need for the eight-step framework for tax-efficient transfers.

On a €50 million transfer, tax liabilities can approach €20 million—an amount sufficient to fund the acquisition of a promising academy graduate. Even clubs outside the upper echelons of the sport cannot afford to disregard such substantial fiscal outflows.

On a €50 million transfer, tax liabilities can approach €20 million—an amount sufficient to fund the acquisition of a promising academy graduate.

Formation of the On-Shore Bid Vehicle (SBV)

Concept

An SBV (Special-Bid Vehicle) is essentially a club’s own firm in its native country that was established to handle the formal acquisition and registration of a new player. By using an SBV, all legal contracts, asset records, and first payments are conducted within the club’s local laws and banking system, building a solid, transparent basis before any offshore tax planning starts.

Example

When Real Madrid agreed to pay €80 million for Jude Bellingham, the club set up RM Football Acquisition SL in Spain. That local entity:

- Signed the transfer contract with Borussia Dortmund

- Opened a Spanish bank account and secured an office address (often via a compliant virtual setup)

- Appointed resident directors

- Capitalized Bellingham’s registration as an intangible asset on its balance sheet

This straightforward step ensured full legal ownership under Spanish jurisdiction and prepared the way for the subsequent offshore structures aimed at optimising the club’s tax position.

Picking & Incorporating the Off-Shore SPV

Next, clubs choose a treaty-friendly jurisdiction and set up an SPV (Special-Purpose Vehicle) to route the fee.

- Treaty Matrix: Compare each country’s standard withholding rate with its reduced treaty rate against key football markets, plus VAT rules and corporate-tax rates.

- Substance Tests: To satisfy local tax authorities, the SPV must have a genuine leased office, at least two resident directors holding regular board meetings, and local bank accounts or minimal staff.

- Top Jurisdictions at a Glance:

- Netherlands: 5 percent treaty withholding; 0 percent corporate tax on qualifying dividends via participation exemption.

- Cyprus: 0 percent VAT on intra-EU sports services; 12.5 percent corporate tax; broad treaty network.

- Malta: Effective ~5 percent corporate tax post-distribution refunds; 0 percent withholding on royalties.

- Ireland: 0 percent withholding on royalties; 12.5 percent corporate tax; R&D credit opportunities.

- Gibraltar: 0–10 percent corporate tax; no VAT on sports services; simple substance rules.

By comparing these options, clubs pinpoint where they’ll maximize withholding-tax cuts, VAT savings, and amortization flexibility, while meeting all local substance requirements.

Routing the Fee via the SPV

Once your on-shore Bid Vehicle (SBV) holds the player registration, you immediately sell it to the offshore SPV at the same price. Here’s how it works:

- Sale Agreement: For the purchase fee, SBV sells SPV the registration rights.

- Treaty-Reduced Payment: SPV uses the low treaty rate to pay the selling club. For example, Spain’s 15% withholding (€12 m) is reduced to 5% (€4 m) when Real Madrid’s €80 m is routed through the Netherlands, saving €8 m up front.

- Receivable Booking: In order to maintain consolidated financials, SBV books an intercompany receivable from SPV. If the SPV retains its genuine content, this one step eliminates the most portion of transfer tax.

This step shaves off the biggest chunk of transfer tax in one move so long as your SPV meets local substance requirements.

Lease-Back / Management-Fee Arrangements

To keep the player “on the books” of your SBV but preserve SPV tax benefits, you structure a lease-back:

- Management-Fee Contract: SPV “leases” the player’s registration to SBV for an annual fee.

- VAT Exemption: Within the EU, intra-group sports-services are zero-rated for VAT, so each invoice runs at 0 %.

- Arm’s-Length Pricing: Fees should reflect market rates (e.g. 5–10 % of the original fee annually) to satisfy transfer-pricing rules.

This arrangement ensures the SPV continues to earn fee income in its favorable jurisdiction, while your club retains full playing rights.

Amortization & Profit-and-Loss Alignment

Rather than expense the full fee up-front, you spread it over the player’s contract term:

- Capitalization: SPV books the inter-company purchase as an intangible asset.

- Straight-Line Amortization: Write off the cost evenly (e.g. €80 m ÷ 6 years = €13.3 m/year).

- Group P&L Sync: SBV mirrors that amortization through the lease-back fees, ensuring consolidated accounts stay aligned and EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization) remains predictable.

This smooths profit-and-loss impact and avoids one-year spikes that can trigger financial-fair-play or loan-covenant issues.

Loans, Dividend Repatriation, and Disposal

The same treaty routing provides tax savings once more when the player moves on, whether they are sold or loaned:

- Loan/Resale Fees: In accordance with its low-withholding agreement, SPV bills the incoming club.

- Dividend Repatriation: SBV (or parent) receives dividends from net proceeds. “Participation exemption” refers to 0% tax on eligible dividend income in countries such as the Netherlands.

- Financial Impact Summary:

To view the entire tax benefit over the player’s lifetime, compare the gross sale price, net after withholding, and net repatriation.

Reporting & Compliance, Remaining Unflappable

Tax officials throughout the world are keeping an eye out for treaty-shopping. In order to secure your savings:

- Economic Substance: Continue to have regular on-site board meetings, make operational decisions, maintain a physical office, and have at least two local directors.

- OECD BEPS & PPT: Provide authentic business justification (such as risk isolation and centralized IP management) to meet the Principal Purpose Test for preventing treaty misuse.

- EU ATAD & DAC6: If relevant, report cross-border agreements within 30 days under DAC6 and abide by the Anti-Tax Avoidance Directive’s regulations (interest-limitation, hybrid mismatches).

- Checklist for Best Practices: For a minimum of seven years, maintain board minutes, intercompany agreements, substance audit reports, and tax counsel opinions on file.

Strong compliance shields your club’s reputation, prevents expensive back-tax assessments, and maintains your tax savings.

Bellingham’s €80 M Move, in Brief

- Tax Mapping: A direct Spanish payment would incur 15 % withholding (€12 m).

- On-Shore SBV: RM Football Acquisition SL signed the €80 m contract and booked the registration.

- Off-Shore SPV: RM Player Services BV was established in the Netherlands with real substance.

- Fee Routing: SPV paid Dortmund with just 5 % withholding (€4 m), preserving €8 m.

- Lease-Back: Annual management fees from RM BV to RM SL run at 0 % VAT.

- Amortization: €80 m capitalized and written off over six years (€13.3 m/year).

- Repatriation: Future sale or loan proceeds flow back tax-free under the Dutch participation exemption.

- Compliance: Quarterly Dutch board meetings, BEPS/PPT documentation and DAC6 notification.

Deep-Dive Case Studies:

| Club | Jurisdiction Chain | Fee | Tax Before | Tax After | Net Saved |

| Real Madrid | ES → NL (SBV + SPV) | €80 m | €12 m | €4 m | €8 m |

| PSG | FR → CY (SPV + lease-back) | €60 m | €9 m | €4 m | €5 m |

| Man City | UK → NL (SPV + image-rights) | €70 m | €10 m | €4 m | €6 m |

| Arsenal | UK → IE (SPV for image/IP) | €50 m | €7.5 m | €3.5 m | €4 m |

PSG Investor Services Ltd. in Cyprus handled the €60 million transfer, investing €5 million in youth facilities and reducing withholding from €9 million to €3 million. Furthermore, intra-group management expenses are billed VAT-free.

Man City’s Dutch Wrap: The City Football Group’s City Football Services BV manages image rights and transfer payments in the Netherlands, generating tax-free money via a 5% withholding and participation exemption on a €70 million package.

Arsenal’s Irish Intellectual Property Structure: Arsenal Image Rights Ltd., an Irish firm, licenses the rights to player pictures and kit sponsorships. With a 25% R&D tax credit and no royalties deducted, this saves over €4 million on a €50 million package.

Conclusion: Leveraging Tax Strategy for Sustainable Success

Clubs can recover more than €10 million in potential tax expenditures by following an eight-step framework that includes carefully identifying all tax exposures, establishing an onshore Bid Vehicle, channeling transfer payments through a treaty-friendly Special-Purpose Vehicle, utilizing lease-back agreements, aligning amortization schedules, repatriating proceeds under participation-exemption rules, and adhering to strict compliance.

For instance, Jude Bellingham’s transfer saved €8 million. Instead of going to other tax authorities, the funds may be used for an expanded youth academy, improved training facilities, or stadium enhancements. Better teams for supporters to support, improved financial outcomes for investors to evaluate, and a solid foundation upon which teams may build long-term success are the straightforward consequences.

Citations:

- UEFA. Club Licensing and Financial Sustainability Regulations (2023 Edition).

UEFA.com › Inside UEFA › Document Library. - OECD. Model Tax Convention on Income and on Capital — Articles 10–12 (Withholding, Royalties, Dividends). 2023.

OECD.org › Tax › Treaties. - European Commission. Anti-Tax Avoidance Directive (ATAD I & II) and Directive on Administrative Cooperation (DAC6). 2024.

Taxation-customs.ec.europa.eu. - HM Revenue & Customs (UK). INTM162040 — Participation Exemption for Foreign Dividends.

GOV.UK › Manuals › International Manual. - Belastingdienst (Netherlands Tax Authority). Participation Exemption and Corporate Tax Regime Overview (2024).

Belastingdienst.nl. - Cyprus Department of Taxation. Corporate Tax and Double-Tax Treaties Index. 2024.

Mof.gov.cy › Department of Taxation. - Irish Revenue. Research & Development Tax Credit Programme — Corporation Tax Manual Part 29-02-03. 2024.

Revenue.ie › Companies and Charities. - Malta Enterprise. Refund Mechanism for Shareholders of Trading Companies (Effective 5 % Corporate Rate). 2024.

Maltaenterprise.com. - FIFA. Regulations on the Status and Transfer of Players. 2023.

FIFA.com › Legal. - Paris Saint-Germain F.C. Annual Financial Report 2022-23 and UEFA Monitoring Submission.

Referenced by L’Équipe and Deloitte Football Money League 2024.

- Companies House (UK). Manchester City Holdings Ltd and City Football Group Ltd – 2023 Filings.

Find-and-update.company-information.service.gov.uk. - Kamer van Koophandel (Netherlands Chamber of Commerce). City Football Services B.V. Corporate Filing.

Kvk.nl. - Companies House (UK) & Irish Companies Registration Office. Arsenal Holdings plc (2023) and Arsenal Image Rights Ltd (Ireland).

Core.cro.ie. - Deloitte. Football Money League 2024 Report.

Deloitte.com/uk/footballmoneyleague. - KPMG Football Benchmark. Player Valuation and Transfer Fee Mechanisms. 2024.

Footballbenchmark.com. - The Guardian (2017) and Financial Times (2017). Coverage of Neymar’s €222 million PSG transfer and fiscal implications.

Search: “Neymar PSG transfer 2017 site:theguardian.com” / “site:ft.com.”

Disclaimer:

The information presented in this article is for educational and analytical purposes only. All examples of financial or tax-planning structures (including the use of Special-Bid Vehicles, Special-Purpose Vehicles, and intra-group agreements) are based on publicly available information and general industry practices in global football.

The analysis does not allege, imply, or suggest that any football club, holding company, or individual has engaged in illegal tax avoidance, evasion, or misconduct.

Financial estimates are simplified illustrations derived from publicly reported figures and typical treaty-based tax rates in relevant jurisdictions (Netherlands, Cyprus, Ireland, Malta, Gibraltar, Spain, France, United Kingdom). The author and The Football Week make no representation regarding the exact accuracy of the monetary amounts or internal accounting treatments.

Readers are encouraged to consult official club filings, UEFA and FIFA financial regulations, and relevant corporate registries for verified data.