As European football undergoes an unprecedented financial transformation, private equity and investment funds are no longer peripheral actors, they are becoming central architects of the sport’s future. This article is the second part of the series “Private Equity in Football: A Game-Changer or a Risky Bet?”, exploring how private equity is reshaping the football landscape, injecting capital and redefining club ownership with both transformative potential and significant risk. In Part 1 of this series, we explored how the financial instability and post-pandemic football opened the door for new types of owners in the football industry. Now, in Part 2, we dig deeper: Who exactly are these investment funds? What are their strategies, their portfolios, and their ambitions in football? From RedBird Capital’s transatlantic empire to CVC’s groundbreaking deals with entire leagues, this article maps the key players reshaping football, not as fans, but as financiers.

We’ll uncover how these funds view clubs as assets within a broader investment portfolio, the logic behind multi-club ownership, and what this means for governance, performance, and long-term sustainability. Whether you’re an investor, club executive, or a fan trying to make sense of it, this piece will give you the financial blueprint behind football’s new era.

Overview of key players

Over the last decade, a wave of investment funds and private equity firms has entered the football industry, seizing opportunities across clubs, leagues, and media rights. Unlike traditional owners, often wealthy individuals or local business figures, these entities operate with a different logic: financial return, strategic asset acquisition, and global brand leverage.

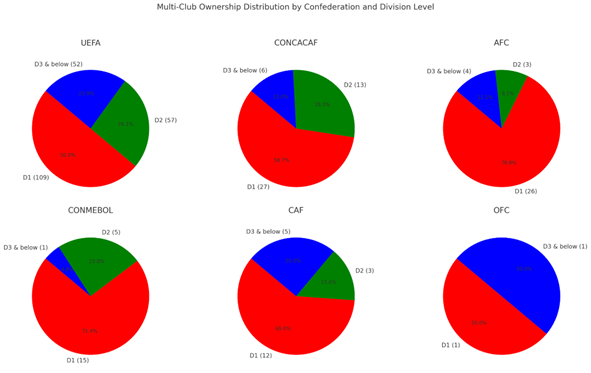

As explained in the first of this series, there are now 125 active MCO groups overseeing approximately 380 clubs worldwide. While the term “multi-club ownership” evokes images of vast football conglomerates, the reality is far more fragmented. The majority of ownership groups operate just two clubs, and fewer than 40% control three or more. This reveals a highly diverse and still maturing ecosystem, ranging from small cross-border partnerships to global investment platforms. Europe remains the strategic core, but MCOs now span every continent and division level, reshaping football’s geography and economic framework. As the model evolves, the next chapter may not be expansion, but consolidation.

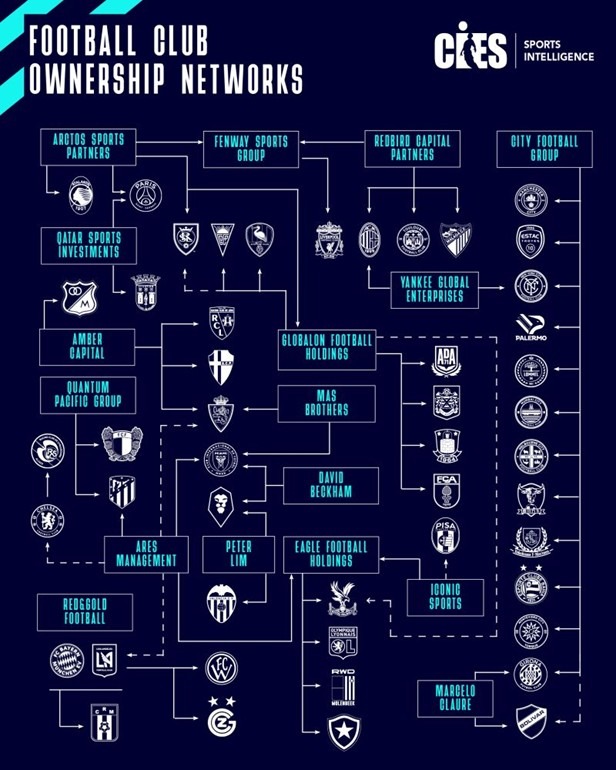

While many MCOs operate on a small scale, a handful of major players are building expansive, interconnected networks across global football. These groups, often backed by private equity or institutional capital, are reshaping the industry through strategic acquisitions, centralized management, and long-term brand building. Below are some of the principal actors driving this transformation with key information:

| Fund Name | Clubs/Assets Owned | Estimated Assets under Management (AUM) ($) | Strategic Focus |

| RedBird Capital | AC Milan (Italy), Toulouse FC (France), minority in Liverpool FC (FSG) | ~ $12B | Equity, media (Skydance), brand building, sports infrastructure |

| 777 Partners / A-CAP* | Genoa (ITA), Standard Liège (BEL), Vasco da Gama (BRA), Hertha BSC (GER), Red Star FC (FRA), Sevilla FC (minority) | ~ $12B | Multi-club strategy, player trading, undervalued assets |

| CVC Capital Partners | LaLiga (8% stake in media revenues), Ligue 1, IPL (Cricket), Six Nations (Rugby) | ~ $223B | Media rights monetization, long-term league partnerships |

| Silver Lake (18%) / Newton Investment and Development LLC | City Football Group including Manchester City, Girona FC, SK Lommel, Palermo FC, New York City FC, Melbourne City FC, ESTAC, Yokohama F. Marinos, Montevideo City Torque, Mumbai City FC, Bahia, Shenzhen Peng City FC, Club Bolivar (Partner club) | ~ $100B (Silver Lake) / N/A (Newton Investment and Development LLC) | Tech-driven branding, data optimization, global sports investments, urban development, brand expansion |

| RedBull GmbH | Red Bull Salzburg, RB Leipzig, New York Red Bull, Red Bull Bragantino, RB Omiya Ardija, Leeds United and Paris FC (minority stake) | N/A (private company) | Brand integration, infrastructure investment, strategic market entry with growth potential |

| Saudi Public Investment Fund (PIF) | Newcastle United and Saudi clubs; Al-Hilal, Al-Nassr, Al-Ittihad, Al-Ahli (League restructuring) | ~ $941B | High-growth sectors such as entertainment, sports, technology, and infrastructure (Vision 2030) |

| Ineos Group | Manchester United (minority stake of 28% with operational control), OGC Nice (17%), Lausanne-Sport (19.9%) | N/A (private company) | Diverse sports portfolio (football, F1, cycling, etc.), brand visibility, community engagement |

| BlueCo | Chelsea FC, RC Strasbourg Alsace | N/A (private football consortium) | Multi-club ownership, youth development, financial sustainability |

| Eagle Football Holdings | Olympique Lyonnais, Botafogo FR, RWD Molenbeek, Crystal Palace (minority stake), FC Florida | ~ $0.9B | Financial strategy: single-account model, targeting clubs with strong heritage and growth potential |

| Pachuca Group | C.F. Pachuca, Club León, Real Ovedio, Everton de Viña del Mar, Club Atlético Atenas, Coyotes de Tlaxcala | N/A (private company) | Multi-club ownership, youth development, infrastructure invesment |

| Oaktree Capital | FC Internazionale (majority via debt default in 2024) | ~ $203B | Distressed assets, strategic control via debt leverage |

| Pacific Media Group/NewCity Capital | Barnsley FC, FC Thun, KV Oostende, AS Nancy Lorraine, Esbjerg fB, FC Den Bosch, FC Kaiserslautern | N/A (private football consortium) | Undervalued clubs in second-tier or struggling leagues by acquiring majority stakes |

| Global Football Holdings | Crystal Palace FC, Real Salt Lake, Augsburg, SK Beveren, Brøndby, ADO Den Haag, Estoril Praia | ~ $12B | Development of sports franchises and infrastructure, technological innovation, venture capital |

*Amid a fraud investigation, 777 Partners has had its assets transferred to A-CAP. Many of the clubs under their control are now pursuing new ownership.

The rise in popularity of multi-club ownership (MCO) is becoming increasingly evident across European football. In the 2023–2024 season, minority and majority ownership stakes in clubs from the Big Five leagues climbed to 41.7%, 40 out of 96 clubs, up from 36.7% the previous year. UEFA reports that the number of clubs under MCO structures has skyrocketed from just 40 in 2012 to 180 by 2022, highlighting a transformative shift in the sport’s ownership landscape.

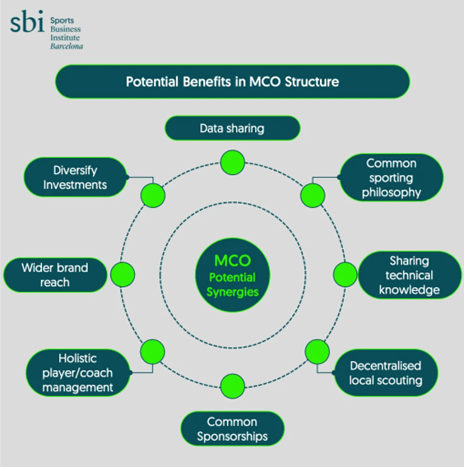

A key driver behind the appeal of multi-club ownership is its capacity to generate synergies, an approach inspired by private equity models of acquisition and value creation. These synergies manifest in various ways, including joint sponsorship deals, streamlined movement of players and coaches, unified scouting operations, enhanced global brand presence, consolidated financial management, and shared data systems leveraging GPS tracking and advanced tactical analysis tools.

What Is the Investment Logic Behind Football?

Multi-club ownership models typically revolve around a ‘flagship club’ competing in one of the more lucrative top-tier leagues, while the remaining holdings consist of satellite clubs operating in smaller, less commercially dominant competitions. At the portfolio level, MCO groups can achieve a higher overall valuation by creating synergies between their clubs, through shared resources, strategy, and operations. This often allows the parent company to command a premium compared to simply adding up the value of each club individually, much like the ‘buy-and-build’ approach used in private equity.

This setup is also designed to minimize conflicts of interest between affiliated clubs that might compete against each other, while the private equity-backed framework aims to replicate the success of the flagship model across the weaker clubs in the portfolio.

Football clubs, especially those in top European leagues, are increasingly being viewed as undervalued global entertainment assets. The logic for funds is rooted in several key pillars:

Asset Appreciation & Long-term value creation

Many historic clubs suffer from poor management but hold immense brand value. Investment funds seek to buy low (during crises or undervaluation), restructure operations, and grow the asset’s worth over time, either to hold or exit. This strategy includes:

- Enhanced Club Valuations Through Synergies: MCO groups benefit from synergies, operational efficiencies, shared resources, and strategic coordination that make the collective portfolio worth more than the sum of individual clubs. This “premium” effect leads to higher valuations for each club, as investors value the benefits of integration and growth potential.

- Player Asset Value Growth: Players are major club assets, and their market value often appreciates through strategic talent development and transfers within the MCO network. By nurturing young players in satellite clubs and eventually transferring or promoting them to flagship teams, MCOs maximize player valuations and generate profitable transfer fees.

- Improved Financial Performance: Cost savings from centralized operations and increased revenues from diversified income streams (broadcasting rights, sponsorships, merchandise, digital content) contribute to healthier balance sheets and cash flows, which positively influence club valuations over time.

- Strategic Capital Investments: MCO owners often invest in infrastructure upgrades, stadiums, training facilities, and technology that enhance the club’s competitive edge and market value. These tangible asset improvements support sustained appreciation and attract further investment.

- Market Dynamics and Football’s Growing Popularity: The global popularity of football continues to rise, increasing demand for club ownership stakes. This macro-level trend drives overall asset price inflation, benefiting well-positioned MCO groups with diverse portfolios.

Synergies through Multi-Club Ownership (MCO)

As explained previously, RedBird, RedBull and many other groups are pioneering network strategies, building ecosystems of clubs across countries. These synergies allow:

- Risk Diversification: By owning clubs in different leagues, countries, or competitive levels, MCO groups can offset poor performance in one market with success in another, reducing overall financial risk.

- Economies of Scale and Operational Synergies: Centralizing functions like finance, HR, scouting, marketing, and player development allows MCO groups to reduce costs and improve operational efficiency. Shared resources create cost savings and better negotiating power with sponsors and partners.

- Talent Development and Flow: MCO structures enable seamless player loans, transfers, and development pathways across clubs. Young talents can be nurtured in smaller clubs before moving to flagship teams, maximizing player value and career growth.

- Brand Expansion and Commercial Growth: Owning clubs in diverse regions broadens the group’s global footprint. This increases sponsorship opportunities, fanbase reach, and merchandising potential, leading to increased revenue streams.

- Data and Analytics Integration: Centralized data systems, including GPS tracking and tactical analytics, help optimize performance and scouting, providing a competitive edge.

- Replication of Successful Models: Private equity-style ‘buy and build’ strategies are applied by replicating successful operational frameworks and branding across all clubs, enhancing overall valuation beyond the sum of individual parts.

- Content and Audience Engagement: Control over content and narratives across platforms boosts fan engagement and commercial appeal, adding intangible but valuable assets to the group’s portfolio.

Football as a Diversification Tool

In recent years, private equity and venture capital firms have increasingly viewed football clubs as valuable diversification assets within their broader investment strategies. This reflects a shift beyond traditional industry sectors into sports, which offers unique characteristics that complement and enhance portfolio resilience and growth.

Non-Correlated Asset: Football clubs operate in a sphere that is largely uncorrelated with traditional financial markets such as equities, bonds, or commodities. This means that the financial performance of a club, driven by ticket sales, broadcasting rights, sponsorships, and player trading, does not always move in tandem with stock markets or economic cycles.

Cultural and Political Footprint: Football clubs carry significant cultural and political influence, particularly in emerging markets and regions where the sport is deeply embedded in social identity. Ownership of a football club offers investors access to local political networks and societal goodwill, which can be leveraged for business expansion or soft power. In countries like the United States, India, or China, where football is growing rapidly, clubs serve as platforms for cultural diplomacy and brand penetration.

Example: City Football Group’s ownership of Mumbai City FC in India has helped them tap into one of the world’s largest and fastest-growing sports markets, gaining both commercial and cultural influence.

Technology and Media Innovation: Football clubs are increasingly used by PE and VC firms as living labs for cutting-edge technologies, including biometric analytics, AI-powered scouting, fan engagement platforms, and digital content monetization. Clubs provide a controlled environment to pilot innovations that can later be scaled across other portfolio companies or industries.

Conclusion

Investment funds and private equity firms have rapidly become key players in European football, shifting the sport’s ownership landscape from traditional local to global, financially driven entities. These funds operate multi-club ownership (MCO) models, with a flagship club in a major league supported by satellite clubs worldwide, creating valuable synergies like shared resources, talent development, and expanded brand reach. This strategy drives long-term asset appreciation, risk diversification, and operational efficiencies, transforming football clubs into high-value entertainment assets. Their growing influence not only reshapes club governance and performance but also leverages football’s cultural and technological potential as a unique, non-correlated investment.

Next in this series, we will take a detailed, step-by-step look at how investment funds acquire and manage football clubs, covering due diligence, financial audits, deal structuring, and governance reforms that shape the new era of football ownership.